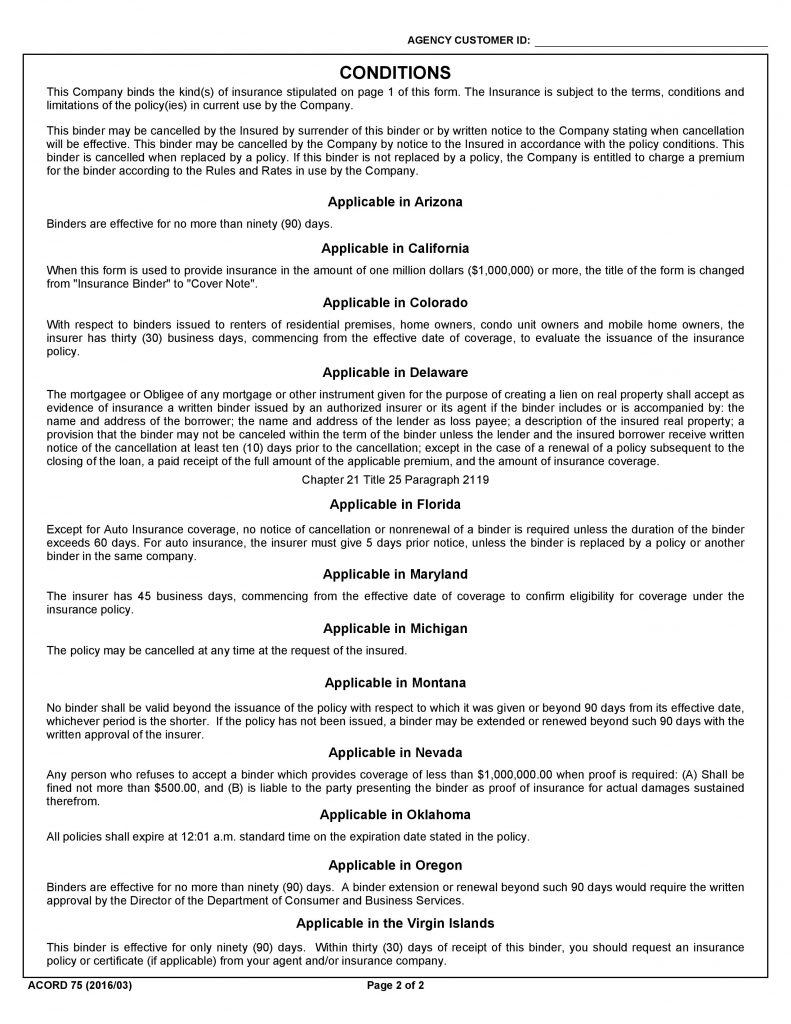

It’s a commitment from the insurance company to insure the property, which includes the summary of what they’re protecting and the limits on that protection. The proof they want to see comes in the form of a binder.Įven if your insurance company provides your policy documents right away, the binder is still probably the thing your lender wants to see. After all, they’ve got a rather large financial interest in the property. They also want to see themselves listed on the insurance policy. When you buy a house, your mortgage lender wants proof that the house is insured. With this document on file, the bank will complete the transaction, release funds, and let Norman get the keys to his new house. The binder states that the policy is enforced as of today’s date, summarizes the coverages and the limits, and lists Norman’s bank as an additional insured. In the meantime, though, they provide him with a binder. Unfortunately, Norman’s insurer is a bit slow they say they’ll take about ten business days to send his insurance policy documents. They won’t complete the transaction and release funds until they see proof of insurance. After all, the bank made a pretty significant investment they don’t want Norman’s house to burn down and lose the opportunity to foreclose on it if Norman stops making his payments. Norman’s bank, from whom he got his mortgage, wants to see that the home is insured. He also just bought an insurance policy to protect his house. You bought an insurance policy, and you need to make a claim before you’ve received your policy documents (a lot less common, but important nonetheless).Your mortgage lender wants proof that the house they’ve just invested in is protected by an insurance policy.There are a few scenarios in which you need a binder, including: (Square One actually refers to our binders as Confirmations of Insurance. In the insurance world, a binder is a temporary document issued by your insurance company that basically says:īinders are temporary confirmations of insurance, to help you get things done while you’re waiting for your final policy to arrive. Meanwhile, the bank that gave you a mortgage is breathing down your neck, waiting for proof that your new house is insured.

Maybe your policy needs to be reviewed by an underwriter, or maybe the insurance company is just a bit slow. Even after you’ve gone through the process with an insurance agent or broker, there might still be a short wait before you get your official policy documents. Buying an insurance policy isn’t quite like buying a slice of pizza they don’t keep insurance policy wordings on a shelf, warm and ready to eat.

0 kommentar(er)

0 kommentar(er)